Ok, so you have decided to build a secondary dwelling on your land, but what are the capital gains tax implications for building a granny flat?

The portion of your property used to build a granny flat will be subject to capital gains tax. From the date you start to derive rental income from it.

For simplicity sake. Let’s say you have 800sqm of land and your granny flat is 60sqm.

DON'T PAY A FORTUNE FOR YOUR GRANNY FLAT. Find out how to deal with council and build a granny flat for the lowest cost possible. Learn More.

Therefore, from the point you derive income from the granny flat until the day you sell it, you are up for paying Capital Gains Tax (CGT) on 60/800 = 7.5% of your land. If the remaining 82.5% of your land was used as your primary place of residence and you never derived income from that portion of it.

In today’s article I go into depth with the help of Christopher Leeson from Alpha Consulting to share valuable information all granny flat owners need to know.

Chris has years of experience with CGT matters

Chris has helped many businesses and advised developers on the tax implications of building and construction in Australia. And I had the chance to pick Chris’ brain to understand what you need to look out for.

I discuss CGT for a granny flat built on your family home (primary residence) or if it was built on an investment property.

I also cover areas about CGT that you probably didn’t consider.

So, let’s get jump right into it.

NOTE: Every person’s circumstance varies. Due to this, please speak with your professional accountant about your individual circumstances.

Granny Flats on your Primary Place of Residence

Let us say you had a property which is your primary place of residence and you built a granny flat on it.

After construction was complete, you determined the value of the property to be worth $1,000,000. From that point on, that would be your cost base for that particular property.

If you derive income from the moment the granny flat was completed, the CGT will be determined from this 1M valuation.

And the liability of CGT will be triggered from this moment you begin deriving an income from the land you live on.

The ATO is clear about when CGT needs to be paid

When you sell the house later on, (with both your home and the granny flat on the land) you’d have to work out what the reasonable portions relate to, that is:

- To what degree the granny flat sale was of the total profit from the proceeds of the property.

And that “portion” related to the granny flat will be subject to capital gains tax.

It comes down to a few things. And it gets a bit complicated, depending on a few aspects below.

An example of such a complication is:

If you purchased a property before 1985 there wouldn’t be any tax to pay on the property (Pre-CGT). However, if you’ve added a new asset to that existing property, then you can actually trigger capital gains tax for that portion of the property.

To reduce complications such as this example above it comes down to one thing.

Maintaining accurate records. And saying, “I’ve got everything recorded.” Such as:

- What I’ve spent on that particular granny flat.

- Every expense incurred for the granny flat.

- Every dollar I earned with the granny flat.

- Understanding the footprint of your land used up for the granny flat.

- Interest expenses (if you borrowed money to build)

These figures mentioned above need to be passed to your accountant so you are paying your fair share of CGT, but not more than you need to.

Building a Granny Flat on an Investment Property

If it’s an existing investment property and you add a granny flat to it, it’s really not too complicated.

Because you’re effectively just increasing the value of an existing asset that’s already subject to capital gains tax, it is cut and dry so-to-speak.

There won’t be exceptions for any part of the land when it comes time to sell.

For example:

If you bought an asset that’s $500,000, and at all times it was used as an investment property, then you sold it later on. The fact that you added a granny flat to it, doesn’t really change it any way.

It just adds extra cost to the original cost base, (to the $500,000). How you then determine the capital gains tax is compared to the price you paid, in this case the 500K.

In essence, when it comes to building a granny flat on an investment property; there’s no difference to capital gains taxes paid on any other investment property.

How to Determine a Cost Base

Whether you are concerned about CGT for a primary residence or for an investment property you need a cost base.

This is the figure for which your CGT calculation will begin from.

There are a few ways to go about getting a cost base for your property:

- Getting a real estate agent (third party source) to value it for you.

- Go to Realestate.com.au or Domain.com.au to look for comparative properties in the area with granny flats on them (again using a third-party website to value the property).

- Registered Property Valuer. A professional researching property valuations in your area.

Once you have your cost base, then it is simple to work out the CGT for an investment property:

Let’s say your cost base (purchase price) of the property was $500,000.

And for simplicity sake you have earned income while you had the property and sell it for $600,000.

$600,000 – (cost base price of $500,000) = $100,000

Your capital gains from the simple transaction would be $100,000 and this is the figure which would be considered for your income tax in the year the property was sold.

To get an in depth view of calculating CGT see this example.

When You Don’t Pay CGT For a Granny Flat

You are always up for capital gains tax if you sell an investment property for more than you purchased it for (including expenses).

However, if you build a granny flat for your teenagers or a growing family and don’t derive any income for doing so, there are no GCT implications.

In this case it is very much like adding an extension to your primary residence.

How Long do You Have to Pay Capital Gains Tax?

It would be by the following May in the next financial year. Your accountant can arrange an extension for tax incurred in a previous financial year.

For example, if you sold it in July you would have a considerable amount of time to pay, (22 months for this example) since the financial year ends on June 30th.

What Happens if you Don’t Pay Capital Gains Tax?

This is no different to not paying any other form of tax. You’d be seriously fined. And if the ATO proves that you were reckless or lied about your tax obligation, your penalty would go up quite substantially.

It can even go up to double what you’d pay.

What if you are Given Money to Build a Granny Flat?

A common scenario is a granny flat agreement:

This is when an agreement is put into place for a family member. Where they agree to pay for the construction of the granny flat to be their place of residence to the end of their days.

The problem with this is you won’t be receiving income (rental income), but there are still capital gains tax implications for this type of transaction.

You have to be very careful how this agreement is drawn up and how the costs are managed. Hence the importance to receive professional advice for your exact circumstances.

Let’s say $100,000 is gifted from a parent to build a secondary dwelling for themselves on their child’s land.

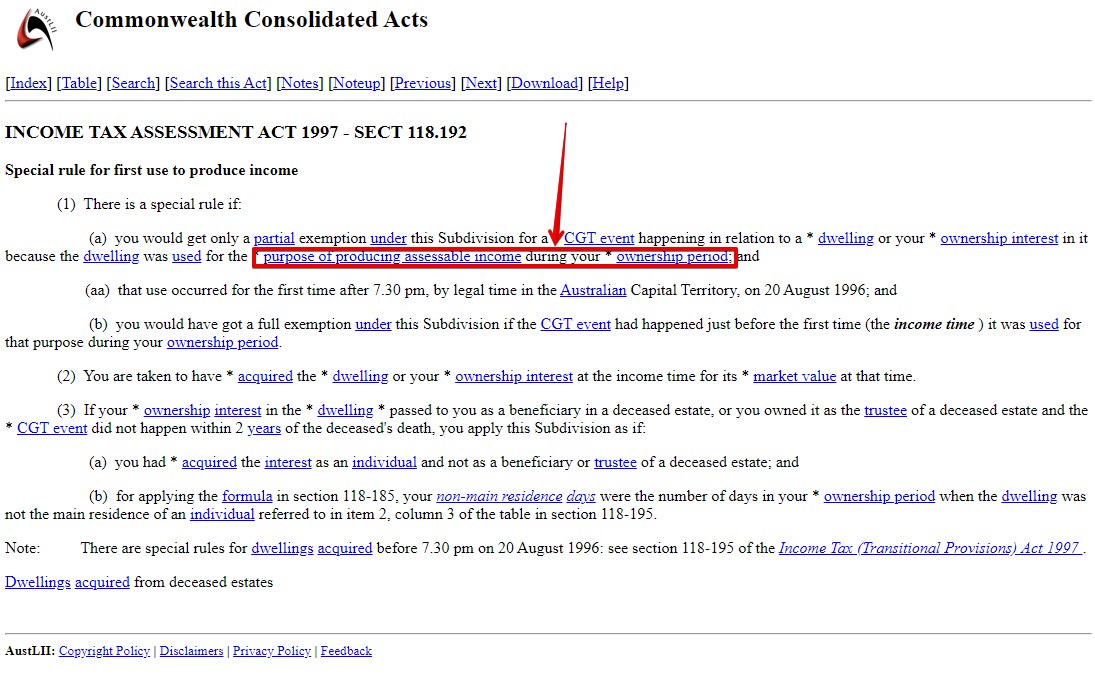

The ATO’s argument is, this person is giving you money, which has actually increased the value of your property, by virtue of that. this is what causes a CGT event to arise.

Simply because you effectively receive income that is being used to increase the value of your property.

That’s where it can get a bit complicated. As what was once black and white blurs on the “grey”.

Another problem that the ATO is trying to curb is where an older parent “gifts” their money to a child. Then turns around to the Government and says “I don’t have any money to retire on, where do I sign up for the pension?”

Building a granny flat under such a circumstance needs to be well planned out before you decide to build.

Ask the ATO Before You do Anything

Chris mentions that you can reduce unknowns by asking the ATO before you build a granny flat.

The way it works is; you send the ATO a letter saying:

“These are my circumstances. This is what I’m considering doing. Can you please advise on the particular capital gains implications, if any, for what I’m proposing?”

And the ATO will come back to you with written advice, saying, “Based on the facts of what you’ve told us, we think there will or won’t be CGT implications for this.”

NOTE: This is something you can do for all circumstances with the ATO. If you’re considering a particular transaction, you can say, “If I’m thinking of buying this property, and doing this with it, are there any implications of such?”

And they will come back to you with a statement as to what the lay of the land is.

The great thing is this whole process doesn’t cost you anything.

Conclusion

Capital gains tax is a tax which is determined by the sale of a property if it was used to derive an income. As granny flats (in many cases) can be rented out, you will fall under the rules of owing the government money.

I hope this article breaks down when CGT is owned after a granny flat is built and when you are free and clear of paying Capital Gains Tax.

If you want to know how these rules relate to your specific circumstance please give Chris’s office a call on: 1300 004 666.