When constructing a granny flat on your property, you have a lot of different types to choose from – so, what is a detached granny flat?

A detached granny flat is a totally separate building. It is fully freestanding with no connection to the main house, and has it’s own entrance. Also called a secondary or ancillary dwelling.

Today I will discuss what the best detached granny flat designs include.

DON'T PAY A FORTUNE FOR YOUR GRANNY FLAT. Find out how to deal with council and build a granny flat for the lowest cost possible. Learn More.

I will also advise you on the advantages and disadvantages of a detached granny flat versus an attached option.

Lastly, I will cover the tangled web of the legal arrangement contracts of granny flat arrangements.

Best Detached Granny Flat Design Includes:

Important factors to consider when planning your detached granny flat include;

- Quality – Your granny flat should suit your own style.

Modern features and layouts can be included in or added to your granny flat.

- Space – Space is an important factor to consider when designing a granny flat.

- A spacious kitchen.

- Open plan living areas – making the kitchen open to the living room and dining area .

- Larger storage areas including walk-in robes.

- En-suite bathrooms.

- Lots of windows for natural light.

- Patio – Patios are a necessity for granny flats to provide outdoor space for the tenants.

They can be added in addition to your allowed living area so you lose no space. It’s ideal for them to have another sliding door entryway into the granny flat for extra privacy.

A detached granny flat is one that is built on the same block of land as your primary dwelling, but not attached at all.

Detached vs. Attached – The Pro’s and Con’s

The benefits of a detached granny flat are:

- Flexibility – You have much more room to play with, allowing more freedom of design.

- Privacy – You are able to give the residents of the granny flat more privacy, such as their own garden space.

- Cost – They can be quite cheap to build, depending on the type you choose, such as a flatpack (kit home).

- Investment – As long as your state allows, you have more freedom and privacy to rent them out as you wish.

The downfalls of a detached granny flat are:

- Room – They are best suited if you have a big block size, as they can take up a lot of space. An attached granny flat is one that is attached to the main home.

The benefits of an attached granny flat include:

- They take up less room – An attached granny flat is a great idea if you have a smaller block size. If you have extra room in or beside your home, you may still be able to build an attached granny flat.

The downfalls of an attached granny flat include:

- They offer less privacy – So, you really need to think about who you want living in it.You may prefer a family member or friend living in it rather than renting it to an unknown tenant.

- Cost – They may actually be more expensive to build. You may need to make structural changes to your main home to ensure it remains long-lasting.

Detached Garage to Granny Flat Conversions

It is easier to renovate an existing space than build a new one. So it is common to wonder “Can I turn my garage into a granny flat?”

Yes – as long as it meets some minimum regulations, including:

- You have a block size of 450sqm or more.

- The garage is no bigger than 60sqm.

- You do not already have a granny flat on your block.

- Your property is zoned as residential, not commercial.

- Location – Where the garage become granny flat is going to be located is very important.

It must be 3m or more from trees and the rear property line, and 0.9m or more from the side boundaries. If the walls are less than the necessary distance from your boundaries, you have another option.

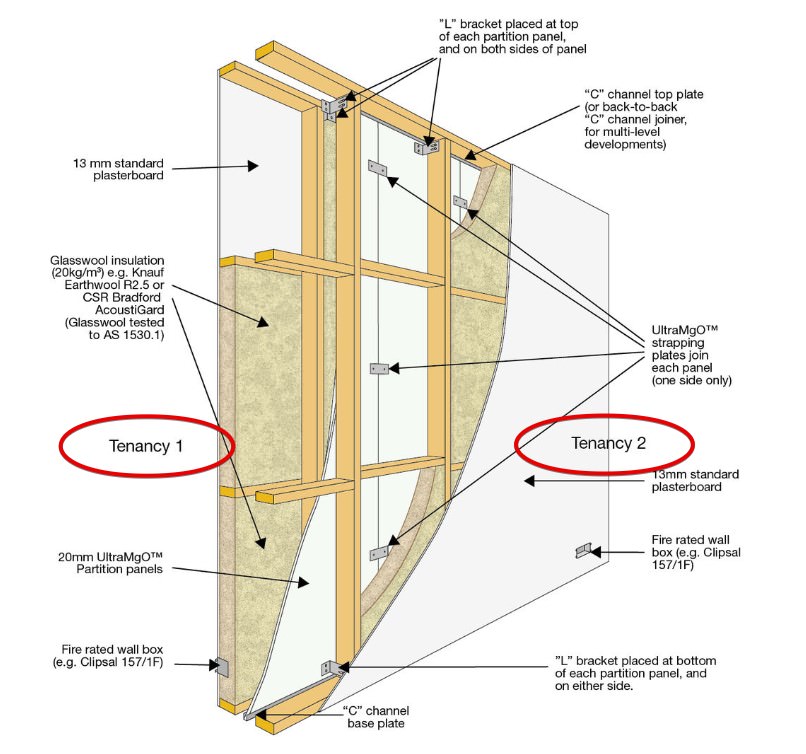

You may still be allowed to go ahead with the conversion by using a fire-rated-wall on that part of the garage.

Source: Fire Proof Cladding

If you have any fascia and eaves, these too must be fire-rated.

Before you begin renovating, you will need to submit your plans to your local council for their approval. As with any building project, you will need to gain the proper permits.

There are some other things you should know before you start planning your garage conversion. Keep reading to find out if it is the right choice for you.

- Minimum Internal Wall Height – The internal wall height of the living area and bedrooms must be at least 2.4m. If you have a cathedral or skillion roof, the average wall-height must be used.

- Floor Drains – The bath/shower and floor of the bathroom must have a floor-drain for waste-water.

This requires:

- Concrete-saw-cutting the existing slab

OR

- Installing a raised concrete floor in the bathroom.

The bonus is that the bathroom only needs a 2.1m high wall, instead of a 2.4m high wall.

- Frame & Slab – An Engineer must certify your Frame & Slab as compliant to the Building Code of Australia (BCA).

- BASIX – Your garage conversion will need to have a BASIX Certificate – this means;

- An energy efficient hot water system.

- A rainwater tank for storm-water drainage.

- Adequate insulation.

- Termite and Water Proofing – Your existing slab must be checked for termite-resistance.

It must be certified by an qualified termite expert. You must also have your bathroom leak-checked and certified by an accredited Waterproofer.

If your property meets the regulations and you are still contemplating a conversion, the next thing to consider is cost.

Renovating any part of a home can be expensive. The average cost for converting a garage into a granny flat is $12 000. This price depends on the size of your garage.

Below are some costs to consider:

- Heating and Cooling – $500 – $2000.

- Plumbing – $1500 +.

- Electricity – $100 – $500.

- Storage cabinets – Cheaper stock cabinets will still cost at least $1500 for a small kitchen

- Drywall – For a two-car garage, you can expect to spend over $2000.

- Paint – While you don’t need to spend a fortune on paint, $800 is a rough estimate.

- Fixtures and Appliances – This includes everything from toilets and sinks, to lighting and an oven. A low estimate is $1800 but you could spend a lot more for luxury.

- Landscaping – Landscaping is an important for privacy for you and your tenants. Expect to spend up to $3000 for a professional to do the work for you.

- Storage or Parking – Your garage was designed for a reason.

You were either using it to park your car, or for storage. You now need to plan for what you will do for extra parking or storage. You may be able to organise your shed for storage, which will cost you nothing.

Or maybe you will need to get a quote from a concreter for parking.

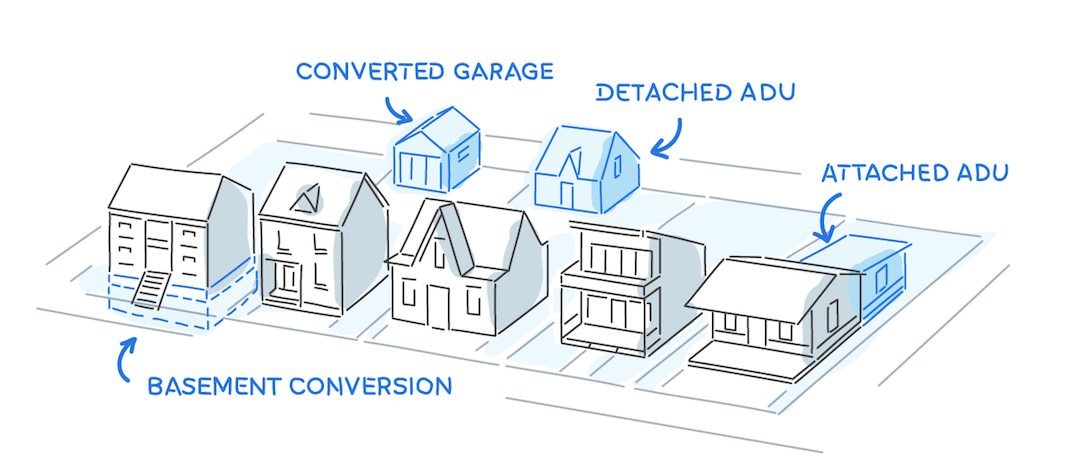

Below are some examples of the various types of secondary dwellings you can choose from. And the conversions which might be possible depending with your local council.

Source: Murray Lambert

Detached Granny Flat Arrangements (Examples Shown)/(Legal Arrangement Contract)

Once you have your detached granny flat created you might be interested in setting up a contract for who you want to live in there.

A Granny flat contract such as this is called a “Granny Flat Arrangement”. So what is a granny flat arrangement exactly?

A “granny flat arrangement” is a situation where a family member lives on the same block of land as another family member. And in exchange for living there they transfer money or assets such as existing property they own.

In return for the right to live in the accommodation. The arrangement is normally structured so they can remain in the accommodation for the rest of their life. The intention is to create a mutually beneficial set-up.

However, there are potential consequences to a granny flat arrangement, these include:

- Unexpected tax – The homeowner will be receiving all rent or assets, and increases in capital value.

- Estate planning – Preparing for the transfer of a person’s wealth and assets after their death may cause issues.

- Centrelink – Particularly, the impact on age pension and home care allowances.

When a person has a granny flat arrangement, special rules apply to determine whether they are or not a homeowner. This will affect the impact it has on an elderly person’s pension entitlements.

- Exit strategies – If the situation does not work as intended.

The granny flat arrangements needs to include what will happen if the family member wants to move out.

For example:

An elderly person may move out within 5 years of starting the arrangement due to something relatively foreseeable. As a result, Centrelink may change how they treat the money they paid or assets they transferred. They count them as a deprived asset for the next 5 years.

As the elderly person may need care in an aged care home, thought needs to be put into how they can pay for this. Consideration needs to be put into the arrangement before it begins as to what will happen if it doesn’t work.

The legal arrangement can come to:

- Sole ownership – The title remains in the original homeowners name, meaning there is no arrangement.

- Co-ownership – Arrangements needing review are tenancy in common, joint tenancy and life estate.

- No ownership – Security of tenure needs to be considered, by a loan, lease or licence at will.

Informed decisions need to be made when considering a granny flat arrangement, including;

- Security of tenure for an elderly person.

- A period of notice .

Where each family member can end their right to residence (except in the case of co-ownership).

- How each person will contribute to combined expenses.

- How each person will contribute to maintenance of the property.

- Payment of rent (if any).

- Exit strategy, including;

How an elder’s cost of residential care will be covered if required. How an elder will be compensated if the living arrangements are otherwise ended. It’s not a straightforward task.

Many lawyers will advise you get:

- Legal advice.

- Tax advice.

- Financial planning advice.

Parent and child should also be independently advised.

Conclusion

A detached granny flat is a freestanding building on the same block as your main home. Whilst they require a lot of room, they are very flexible, allowing you freedom with your design. They can also be quite inexpensive to build, you can even convert your garage into a detached granny flat.

A detached granny flat gives you a lot of privacy, and with that gives you the option to rent it out to more people. You can choose to rent it out to a total stranger rather than a family member. This may save you from entering a habitat that is fraught with difficulties – the detached granny flat arrangement.

Succession issues, security of tenure, retrieval of investment, and reduced pension entitlements are just some concerns that can make the best intentions from family members in a granny flat arrangement fragile.

Sources

- https://www.grannyflatapprovals.com.au/how-to-design-granny-flat-conversions-with-fire-rated-walls/

- https://murraylampert.com/college-kids-and-granny-flats/#